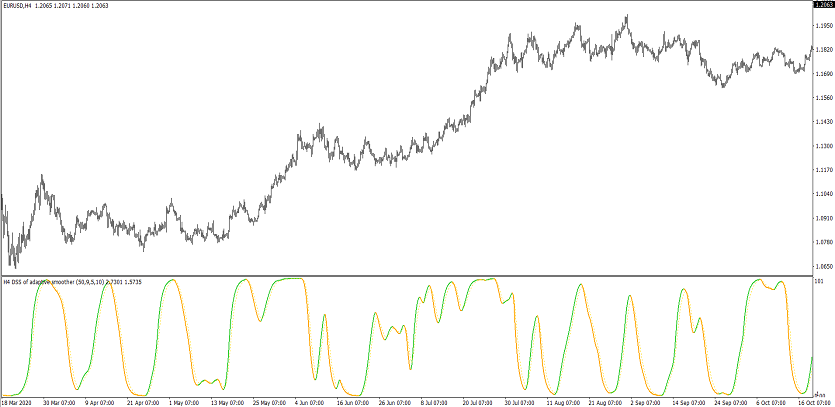

DSS of Adaptive Super Smoother (MT4)

DSS of Adaptive Super Smoother blends Double‑Smoothed Stochastic (DSS) with Adaptive Super Smoother (Ehlers) filtering. The result is a clean momentum oscillator that adapts to volatility and reduces whipsaw in MetaTrader 4.

What it shows

- DSS core (two‑stage stochastic) for smoother momentum waves.

- Adaptive Super Smoother filter that auto‑adjusts to market speed (less lag vs classic MA filters).

- OB/OS bands (e.g., 80/20), 50 midline, and optional signal/trigger line.

- (Optional) arrows/alerts — crosses of trigger/50, OB/OS exits, and slope flips.

Trade ideas

- Flip → first pullback: after a 50‑line cross up, buy the first shallow pullback while DSS holds > 40–45 (mirror for shorts).

- Trend‑aligned dips: in an uptrend, use DSS hooks up from 40–50 as continuation entries; take profits into 80–90.

- Range fades: when regime is flat, fade exhausted 80–90 spikes back toward 50/midline.

- (Optional) Divergence check: confirm with price HH/HL or LL/LH vs DSS slope.

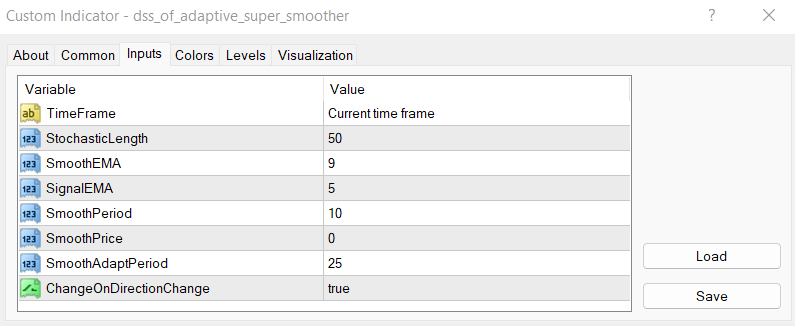

Inputs that matter

- DSS periods — sensitivity of the stochastic stages.

- Adaptive Smoother length — smoothness vs lag.

- Levels — OB/OS (80/20 by default), midline 50.

- Alerts — crosses, exits, slope changes.

- Colors/widths — fast visual read.

Suggested usage

- M5–M15: momentum flips and pullbacks.

- M30–H4: swing continuations; flip → pullback → resume.

- Daily+: bias/regime map.

Installation (MT4)

- Open MetaTrader 4 → File → Open Data Folder.

- Copy

dss_of_adaptive_super_smoother.ex4to MQL4/Indicators. - Restart MT4 (or refresh Navigator) and attach DSS of Adaptive Super Smoother.

- Tweak inputs → OK.

FAQ

Does it repaint? No on closed bars; adaptive filtering is non‑repainting.

Use in EAs? Yes, via iCustom.

Markets? FX, indices, metals, crypto — anything on MT4.

Disclaimer: Test on a demo account first; risk management is essential.