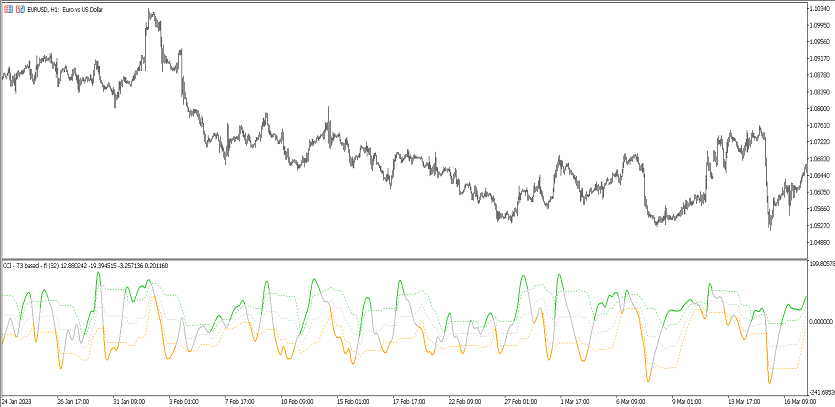

CCI T3‑Based (fl) (MT5)

CCI T3‑Based (fl) fuses the classic Commodity Channel Index (CCI) with T3 smoothing and floating levels (fl). It aims to keep responsiveness while cutting noise/whipsaws, so you can time pullbacks, continuations and early reversals in MetaTrader 5.

What it shows

- CCI core with T3 smoother (less lag than EMA/SMMA at comparable smoothness).

- Floating levels around the midline (e.g., dynamic ±100/±200) that adapt to volatility/regime.

- (Optional) arrows/alerts — zero/level crosses, T3 slope flips, and zone exits/entries.

Trade ideas

- Trend‑filtered pullbacks: trade with the T3 slope; buy CCI pullbacks toward 0 / −100 in uptrends (mirror for shorts).

- Flip → first pullback: after a CCI zero‑flip, wait for a shallow pullback that holds above/below zero, then re‑enter.

- OB/OS fades: in sideways regimes, fade floating‑level extremes (e.g., ±200) back to the midline/T3.

- (Optional) Divergence check: confirm with HH/HL or LL/LH against the T3‑filtered CCI.

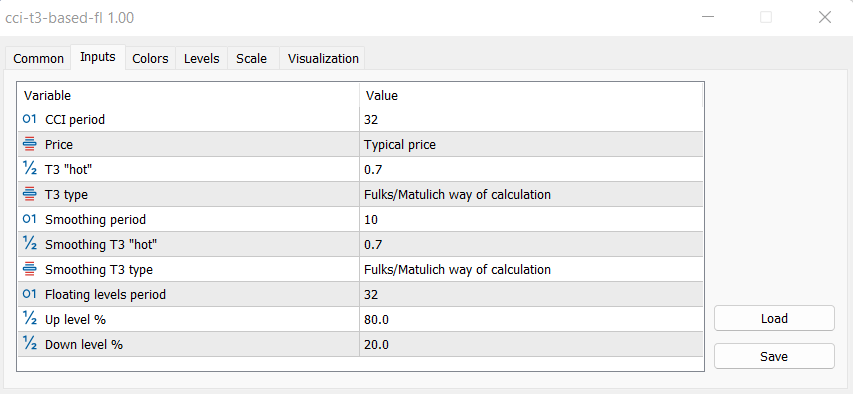

Inputs that matter

- CCI period — sensitivity vs stability.

- T3 length / hot (b) factor — smoothness vs lag.

- Floating levels — bias (±100) and extremes (±200), or custom.

- Alerts — crosses, slope flips, zone events.

- Colors/widths — fast visual read.

Suggested usage

- M5–M15: intraday pullbacks with T3 filter.

- M30–H4: swing continuations; flip → pullback → resume.

- Daily+: bias/regime read and risk tilt.

Installation (MT5)

- Open MetaTrader 5 → File → Open Data Folder.

- Copy

cci-t3-based-fl.ex5to MQL5/Indicators. - Restart MT5 (or refresh Navigator) and attach CCI T3‑Based (fl).

- Tweak inputs → OK.

FAQ

Does it repaint? T3 smoothing is non‑repainting on closed bars; signals confirm on close.

Use in EAs? Yes, via iCustom.

Markets? FX, indices, metals, crypto — anything on MT5.

Disclaimer: Test on a demo account first; risk management is essential.