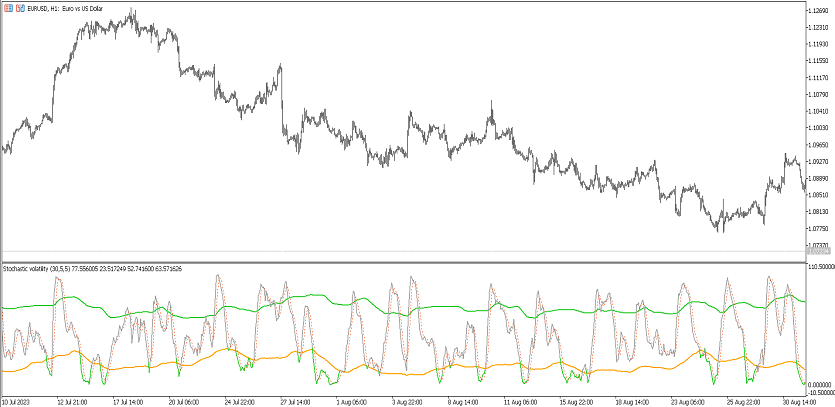

Stochastic Volatility (MT5)

Stochastic Volatility fuses a Stochastic oscillator with a volatility‑aware normalization/filter. Signals adapt to changing volatility: cleaner OB/OS reads, more reliable crosses, and better pullback timing in MetaTrader 5.

What it shows

- %K and %D with volatility normalization — keeps oscillations meaningful across calm/choppy regimes.

- OB/OS zones — typical 20 / 80 (adjustable) with dynamic sensitivity in high/low vol.

- (Optional) arrows/alerts — %K/%D crosses, zone exits/entries, midline (~50) crosses and slope flips.

Trade ideas

- Trend pullback: in an uptrend, look for dips of %K into 20–40 followed by a %K over %D reclaim; mirror for shorts with 60–80 then %K < %D.

- Regime‑aware filter: require volatility contraction → trigger for entries after a sharp expansion.

- First cross after flip: when the composite reclaims 50, the first pullback that holds often continues.

- (Optional) Mean‑reversion in ranges: fade exhausted extremes back to midline; confirm with price structure.

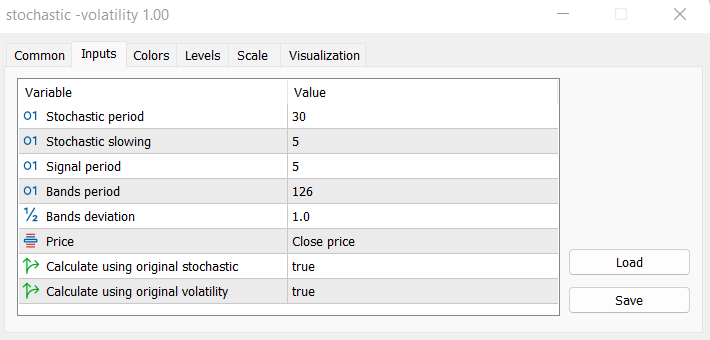

Inputs that matter

- %K period / smoothing — responsiveness vs stability.

- %D period — confirmation signal.

- Volatility window / method — normalization strength.

- OB/OS levels — defaults 20/80; adapt to the asset.

- Alerts — crosses, zones, midline and slope changes.

- Colors/widths — quick visual read.

Suggested usage

- M5–M15: intraday pullbacks and quick reversions with vol‑filter.

- M30–H4: swing continuations; wait for contraction → trigger.

- Daily+: bias/overheat read for portfolio tilt.

Installation (MT5)

- Open MetaTrader 5 → File → Open Data Folder.

- Copy

stochastic -volatility.ex5to MQL5/Indicators. - Restart MT5 (or refresh Navigator) and attach Stochastic Volatility.

- Tweak inputs → OK.

FAQ

Does it repaint? No on closed bars; triggers confirm at close.

Use in EAs? Yes, via iCustom.

Markets? FX, indices, metals, crypto — anything on MT5.

Disclaimer: Test on a demo account first; risk management is essential.