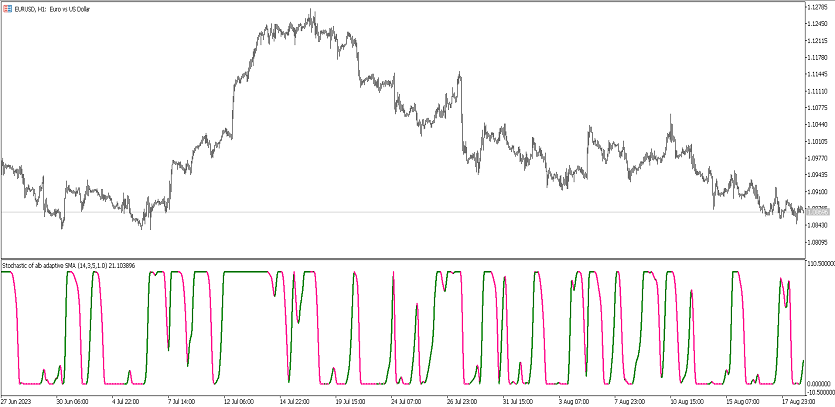

Stochastic of ALB Average (MT5)

Stochastic of ALB Average applies the classic Stochastic oscillator to an ALB Average (a smoothed/adaptive baseline). You get fast momentum turns with reduced noise, clear %K ↔ %D crosses, and zone logic for MetaTrader 5.

What it shows

- %K and %D built on an ALB‑smoothed price/average, giving cleaner oscillations.

- OB/OS zones (e.g., 20 / 80, adjustable) for mean‑reversion and trend‑resume patterns.

- (Optional) arrows/alerts — %K/%D cross, zone exits/entries, mid‑line (~50) crosses and slope flips.

Trade ideas

- Trend pullback: with higher‑TF uptrend, buy when %K reclaims above %D after dipping into 20–40; mirror for shorts with 60–80.

- Flip + first retest: after a midline (~50) reclaim, the first pullback that holds the new side often continues.

- Range mean‑reversion: fade exhausted zone‑stays back toward midline, seek confirmation with price/ALB slope.

- (Optional) Multi‑TF filter: use higher‑TF Stochastic/ALB slope to define regime, trade on lower TF.

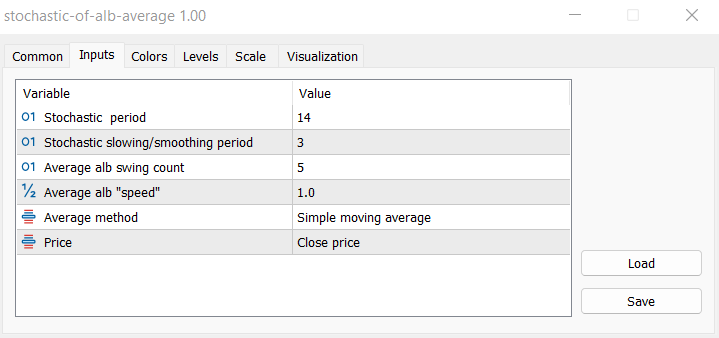

Inputs that matter

- %K period / smoothing — responsiveness vs stability.

- %D period — signal confirmation.

- ALB average length — smoothness vs lag.

- OB/OS levels — 20/80 by default.

- Alerts — crosses, zones, midline and slope changes.

- Colors/widths — quick visual read.

Suggested usage

- M5–M15: intraday pullbacks and quick reversions.

- M30–H4: swing continuations with zone and slope filters.

- Daily+: bias/overheat read for portfolio tilt.

Installation (MT5)

- Open MetaTrader 5 → File → Open Data Folder.

- Copy

stochastic-of-alb-average.ex5to MQL5/Indicators. - Restart MT5 (or refresh Navigator) and attach Stochastic of ALB Average.

- Tweak inputs → OK.

FAQ

Does it repaint? No on closed bars; crosses confirm at close.

Use in EAs? Yes, via iCustom.

Markets? FX, indices, metals, crypto — anything on MT5.

Disclaimer: Test on a demo account first; risk management is essential.