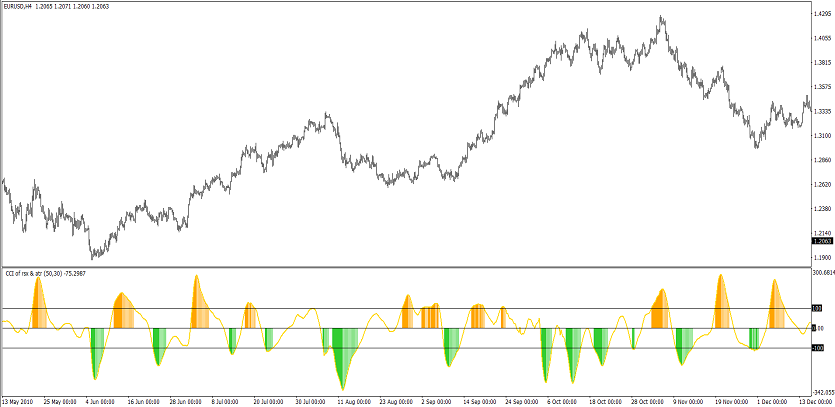

CCI of RSX ATR (MT4)

CCI of RSX ATR fuses a smoothed RSX (Jurik‑style RSI) with CCI logic and ATR‑aware scaling. You get a momentum oscillator that adapts to volatility, reads overbought/oversold more robustly, and highlights pullbacks vs. thrusts in MetaTrader 4.

What it shows

- Core line (CCI of RSX) in −100…+100 style zones.

- ATR normalization to keep readings comparable across symbols/timeframes.

- (Optional) markers/alerts: 0/±100 crosses, zone exits/entries, slope flips.

Trade ideas

- Regime bias: prefer longs while the oscillator holds > 0 with rising slope; shorts while < 0.

- First exit from extreme: in an up‑bias, buy the first move out of oversold; in a down‑bias, sell the first move out of overbought.

- Pullback continuation: after a strong thrust, wait for a return to mid‑zone and a hook back in trend direction.

- (Optional) Divergence with price at new extremes — treat as early caution, seek confirmation.

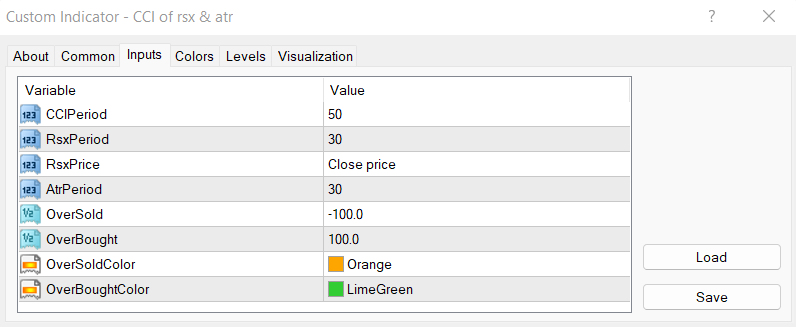

Inputs that matter

- RSX period / smoothing — responsiveness vs. smoothness.

- CCI length — how tightly extremes are defined.

- ATR period / factor — volatility normalization.

- Alerts — level touches, crosses, slope flips.

- Colors/widths — quick visual read.

Suggested usage

- M5–M15: intraday rotations and pullback timing.

- M30–H4: swing continuation with 0‑line filter.

- Daily+: portfolio regime filter.

Installation (MT4)

- Open MetaTrader 4 → File → Open Data Folder.

- Copy

CCI of rsx & atr.ex4to MQL4/Indicators. - Restart MT4 (or refresh Navigator) and attach CCI of RSX ATR.

- Tweak inputs → OK.

FAQ

Does it repaint? No; calculations are on closed bars.

Use in EAs? Yes, via iCustom.

Markets? FX, indices, metals — anything on MT4.

Disclaimer: Test on a demo account first; risk management is essential.