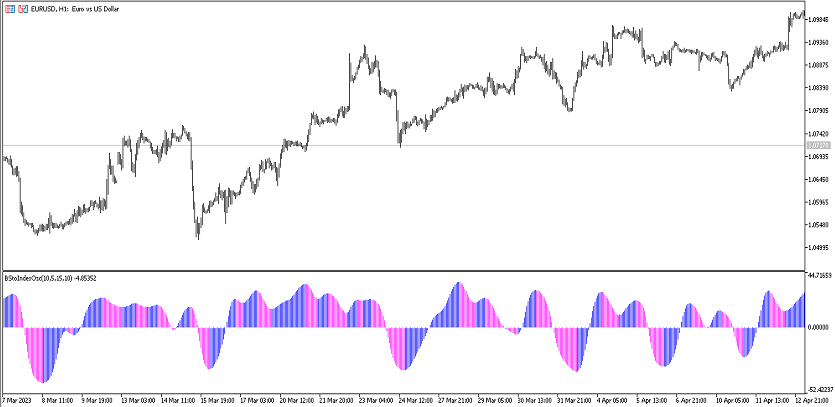

Blau Stochastic Index (MT5)

Blau Stochastic Index refines the classic stochastic with adaptive smoothing and clearer zone/turning‑point reading. It helps time pullbacks and continuations while keeping whipsaws in check in MetaTrader 5.

What it shows

- BSI line (0–100) with zones (e.g., 20/80 or 30/70).

- Smoothing/adaptive options to reduce noise without losing responsiveness.

- (Optional) markers/alerts for 50‑cross, zone exits/entries, slope flips.

Trade ideas

- Regime bias: prefer longs while BSI holds > 50, shorts while < 50.

- Zone rotations: in an up‑bias, buy the first exit from oversold; in a down‑bias, sell the first exit from overbought.

- Pullback continuation: after a trend push, wait for a hook back from mid‑zone in the trend direction.

- (Optional) Divergence: price prints a new extreme while BSI doesn’t — caution, seek confirmation.

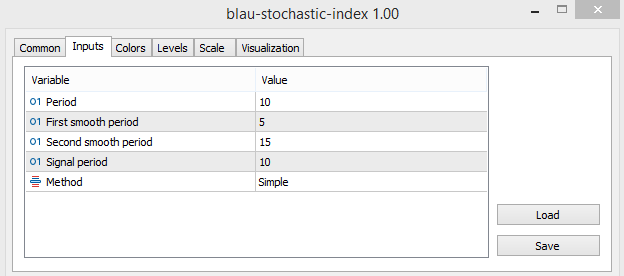

Inputs that matter

- Length / smoothing — sensitivity vs. stability.

- Price source — Close/Typical/Weighted, etc.

- Signals/levels — 20/80 or 30/70 zones; 50‑line logic.

- Alerts — 50‑cross, zone touches/exits, slope flips.

- Colors/widths — quick visual read.

Suggested usage

- M5–M15: intraday rotations and pullbacks.

- M30–H4: swing continuations with 50‑line filter.

- Daily+: portfolio regime filter.

Installation (MT5)

- Open MetaTrader 5 → File → Open Data Folder.

- Copy

blau-stochastic-index.ex5to MQL5/Indicators. - Restart MT5 (or refresh Navigator) and attach Blau Stochastic Index.

- Tweak inputs → OK.

FAQ

Does it repaint? No; values are calculated on closed bars.

Use in EAs? Yes, via iCustom.

Markets? FX, indices, metals, crypto — anything on MT5.

Disclaimer: Test on a demo account first; risk management is essential.