Mass Index - Range expansion reversal gauge (MT4)

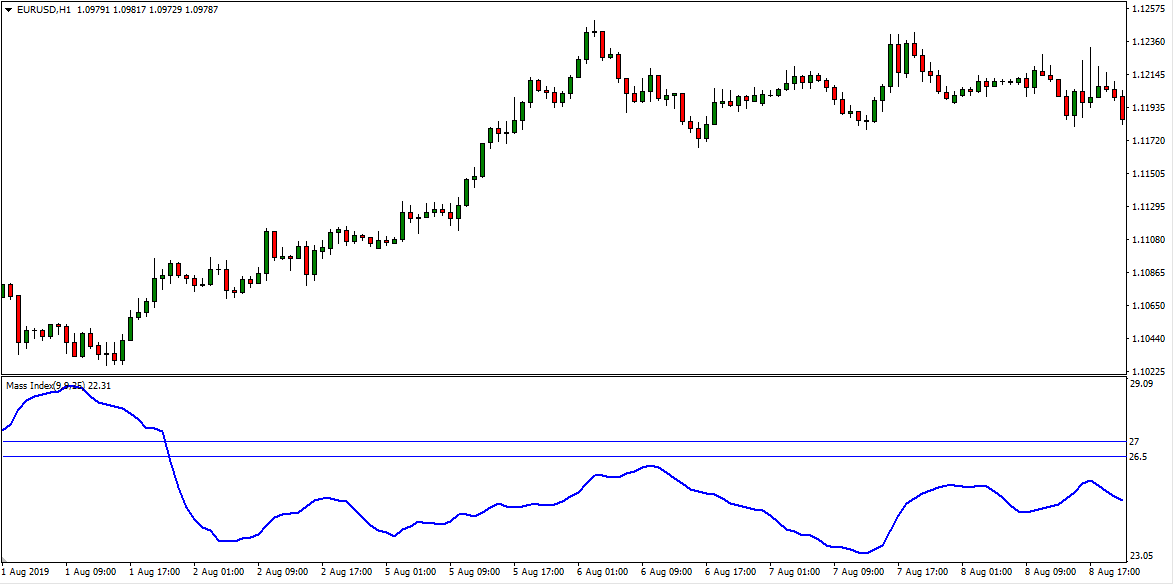

Mass Index measures range expansion by tracking the ratio of EMA of the High-Low range to its own EMA and summing it over time. A rising bulge warns that reversal risk is building, then a roll down signals potential trend change on MetaTrader 4.

What it shows

- Bulge: Mass Index rises above a threshold - expansion and exhaustion risk.

- Dry-up: index rolls over and drops - potential reversal window.

- Non directional by itself - combine with price structure or a trend filter.

- Optional alerts on bulge cross up, cross down and exit from the window.

Trade ideas

- Bulge then roll: wait for the index to cross above the bulge level then turn down - trade a reversal with confirmation.

- Trend filter: only take reversal setups against a stretched swing and near S or R.

- Breakout check: ignore early signals while price has not broken structure.

- Multi TF: watch Daily bulges for bias, time entries on H1 or M15.

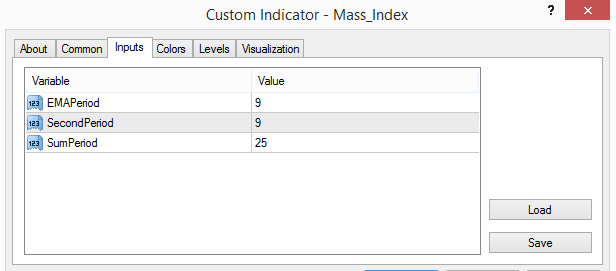

Inputs that matter

- Sum period (classic 25).

- EMA lengths for range and smoothing.

- Bulge level (for example 27.0) and exit level.

- Alerts and visual thresholds.

Suggested usage

- M5-M15: intraday exhaustion checks and scalps with structure breaks.

- M30-H4: swing reversals and failure tests of highs or lows.

- Daily+: regime shifts and risk trimming.

Installation (MT4)

- Open MetaTrader 4 - File - Open Data Folder.

- Copy

Mass_Index.ex4to MQL4/Indicators. - Restart MT4 or refresh Navigator and attach Mass Index.

- Adjust inputs - OK.

FAQ

Does it repaint? No on closed bars.

Directional? Mass Index is volatility based and does not provide direction - use structure or MA for bias.

Use in EAs? Yes, via iCustom.

Disclaimer: Always test on a demo first - risk management matters.