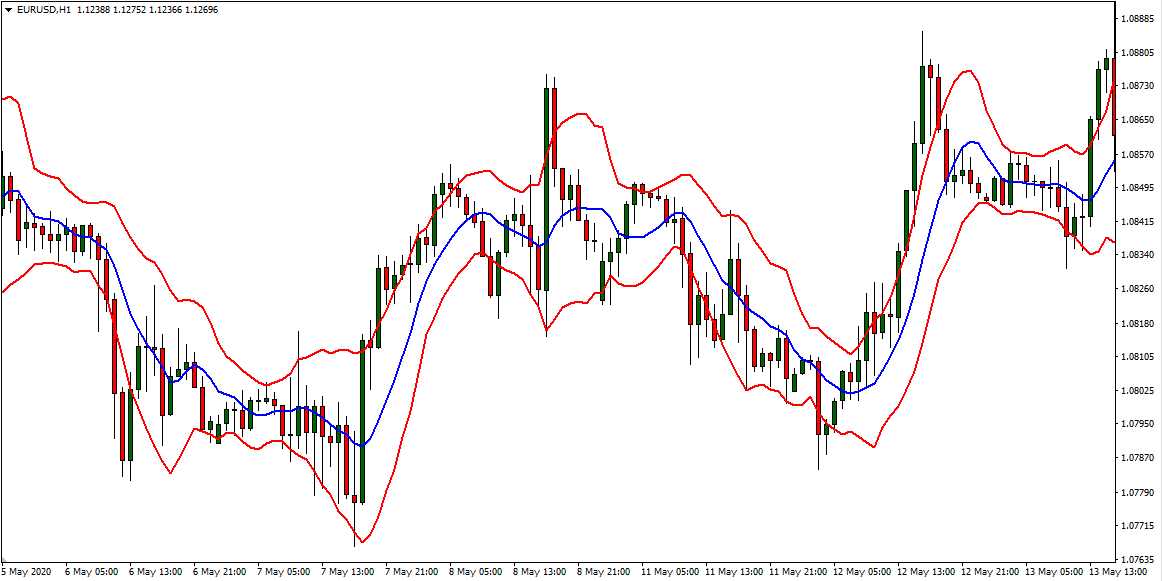

Keltner Channel - EMA plus ATR volatility bands (MT4)

Keltner Channel plots an EMA midline with ATR based envelopes. The bands expand and contract with volatility and price trend follows the midline. Great for pullback entries, breakout validation and trend trailing on MetaTrader 4.

What it shows

- Midline: EMA direction is the primary bias.

- Upper and lower bands: dynamic targets and pullback zones.

- Squeezes: narrow bands suggest upcoming expansion.

- Breakouts: closes outside a band can start a run when the midline agrees.

Trade ideas

- EMA pullback: in an uptrend buy the pullback to the midline or upper band retest after a close above. Mirror for shorts.

- Channel ride: trail stops behind the opposite band while the midline keeps its slope.

- Squeeze break: when bands compress, wait for a close outside plus midline alignment.

- Multi TF: get bias on H1-H4, time entries on M5-M15 when price flips with midline.

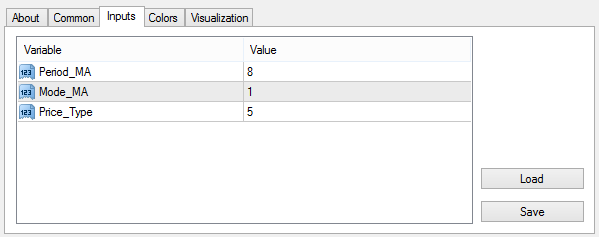

Inputs that matter

- EMA period for the midline.

- ATR period and multiplier for band width.

- Applied price and optional smoothing.

- Alerts on band touches and breaks if available.

Suggested usage

- M5-M15: pullbacks and exits.

- M30-H4: swing continuation and breakout checks.

- Daily+: regime bias and trailing logic.

Installation (MT4)

- Open MetaTrader 4 - File - Open Data Folder.

- Copy

Keltner Channel Indicator.ex4to MQL4/Indicators. - Restart MT4 or refresh Navigator and attach Keltner Channel.

- Adjust inputs - OK.

FAQ

Does it repaint? No on closed bars.

Keltner vs Bollinger? Keltner uses ATR instead of standard deviation so the band shape is smoother and trend friendly.

Use in EAs? Yes, via iCustom.

Disclaimer: Always test on a demo first - risk management matters.