ADX - Average Directional Movement Index (MT4)

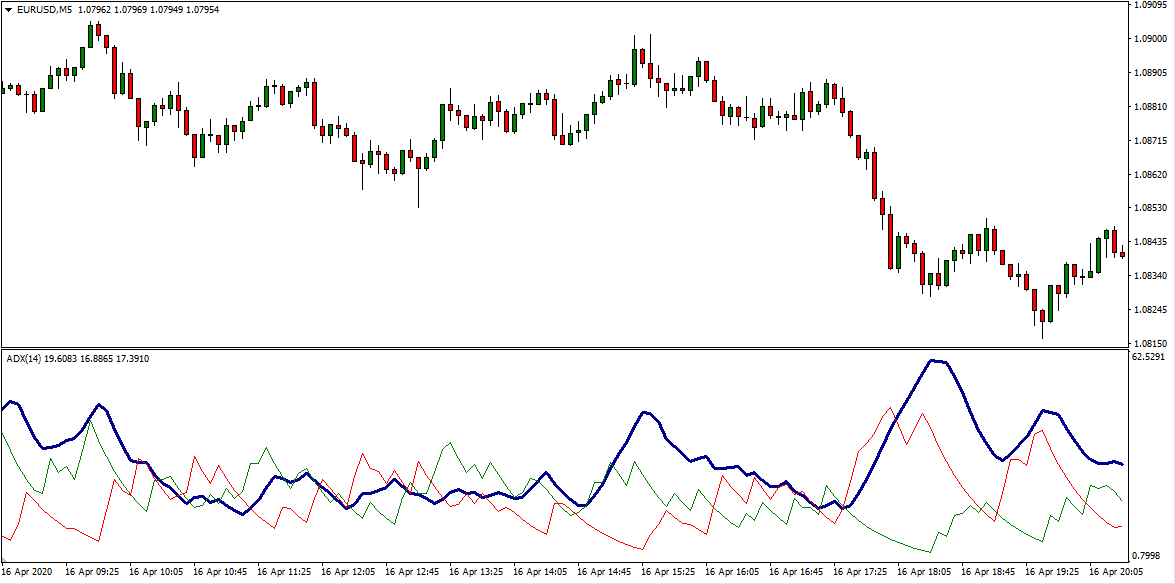

ADX measures trend strength on a 0-100 scale while +DI and -DI show directional pressure. Rising ADX means strength is building whether the trend is up or down. Use crossovers of +DI and -DI plus ADX slope to filter entries on MetaTrader 4.

What it shows

- ADX: trend strength. Typical thresholds: 20-25 start of trend, 30+ strong.

- +DI and -DI: buying vs selling pressure. Crossovers hint at control changes.

- ADX rising: strengthening regime. ADX falling: consolidation or fade.

- Optional alerts on DI cross, ADX threshold cross and slope flip.

Trade ideas

- DI cross with ADX rising: buy when +DI crosses above -DI and ADX rises from below 20-25. Opposite for sells.

- Trend add: in an established move, add while ADX keeps rising and pullbacks hold structure.

- Range filter: avoid breakout trades when ADX is falling below 20.

- Multi TF: require higher TF ADX above 20 and DI alignment for lower TF entries.

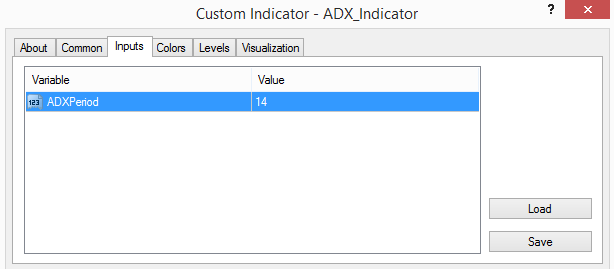

Inputs that matter

- Period (classic 14) and smoothing method (Wilder by default).

- Price source for true range and DM calculation.

- Alerts for DI cross and ADX levels.

Suggested usage

- M5-M15: filter chop and time momentum bursts.

- M30-H4: trend following and add on pullbacks.

- Daily+: regime map and position sizing.

Installation (MT4)

- Open MetaTrader 4 - File - Open Data Folder.

- Copy

ADX_Indicator.ex4to MQL4/Indicators. - Restart MT4 or refresh Navigator and attach ADX.

- Adjust inputs - OK.

FAQ

Does it repaint? No on closed bars.

Why can ADX rise in a downtrend? It measures strength, not direction. Direction comes from +DI and -DI.

Use in EAs? Yes, via iCustom.

Markets? FX, indices, metals, crypto - anything on MT4.

Disclaimer: Always test on a demo first; risk management matters.